The export restrictions that the US government placed on Nvidia are creating a ready market in China for Huawei’s new AI chips.

Huawei developed its Ascend 910B chip as a direct alternative to Nvidia’s popular A100 GPU. Huawei released the Ascend 910 in 2018 as the first step in its aim to establish a full-stack AI portfolio.

The upgraded Ascend 910B hasn’t been officially launched but is believed to have computing power comparable to Nvidia’s A100 while its overall performance still lags behind the A100.

As Chinese AI companies can no longer buy Nvidia’s high-end chips, the Ascend 910B is seen as a viable alternative. Tech company Baidu, maker of the Ernie Bot chatbot, ordered 1,600 of the chips earlier this year.

The order is reportedly worth 450 million yuan, or just over $61 million. That’s a small fraction of the sales volume Nvidia was doing in China until recently but it may be a sign of things to come.

Other big companies with AI aspirations like Alibaba and Tencent will also need to consider alternatives when their current Nvidia systems reach capacity. Huawei’s Ascend 910B seems the best alternative for now.

Chinese AI giant iFlyTek has been working with Huawei to develop hardware based on the Ascened 910B. The company’s CEO Liu Qingfeng said that Huawei’s new GPU was “basically the same as Nvidia’s A100.”

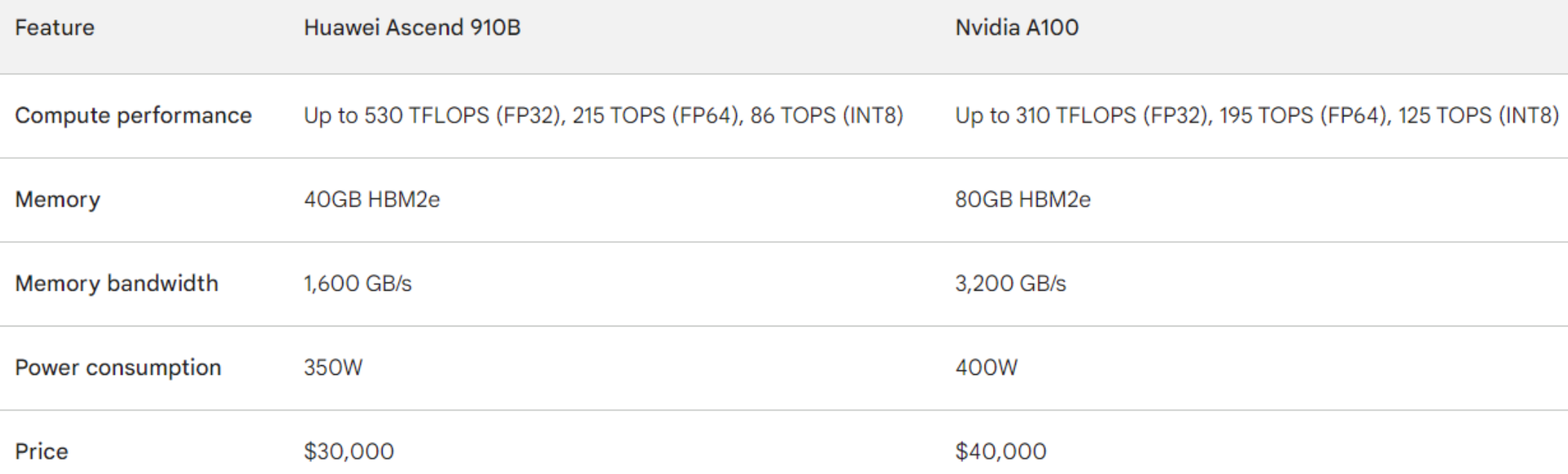

While no official figures have been released here’s a snapshot of an unofficial comparison with Nvidia’s A100.

The Ascend 910B pricing in this comparison is a little optimistic and is closer to $38,000.

Analysts estimate that China’s AI chip market is worth around $7 billion so there’s a lot of incentive for Huawei to turn performance claims into benchmarked facts.

Were the US export restrictions a good idea?

When the US government ratcheted up its export controls of Nvidia’s AI chips it was partly because it feared these could be used in Chinese AI-powered defense tech.

By withholding access to the chips it hoped to slow Chinese AI innovation. The unintended consequence of the policy is that it may have accelerated the Chinese path to self-reliance.

Huawei has been a specific target of US trade restrictions too. It was placed on a Commerce Department blacklist that bars American companies from exporting to Huawei without a special license.

The consequence is that Huawei has had to diversify its supplier base away from US companies and focus on developing its own capabilities to fill the gaps. Notably, Huawei produced its Kirin 9000 chip in 2021 which was the world’s first 5nm chip.

Huawei previously had the majority of its chips manufactured by Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest chip foundry.

Recent trade restrictions have forced it to start using China’s largest chip foundry, Semiconductor Manufacturing International Corporation (SMIC), to manufacture its chips. SMIC is still not as advanced as TSMC, but it has made significant progress in recent years.

As the AI race continues it seems that China is shrugging off US attempts to slow it down and is becoming increasingly tech-independent.

And with the US heavily dependent on the manufacturing capabilities in Taiwan, its AI supremacy seems more exposed to geopolitical shifts there than ever.