A flawed report by Goldman Sachs analyst Peter Oppenheimer may have been behind the significant negative sentiment for AI shares over the last few days.

There have been rumors of a potential AI bubble as tech prices continue to rise and Oppenheimer’s reports indicated that the tide was about to turn. Oppenheimer’s report relied on a graph that seemed to indicate that the number of users of OpenAI’s ChatGPT was declining.

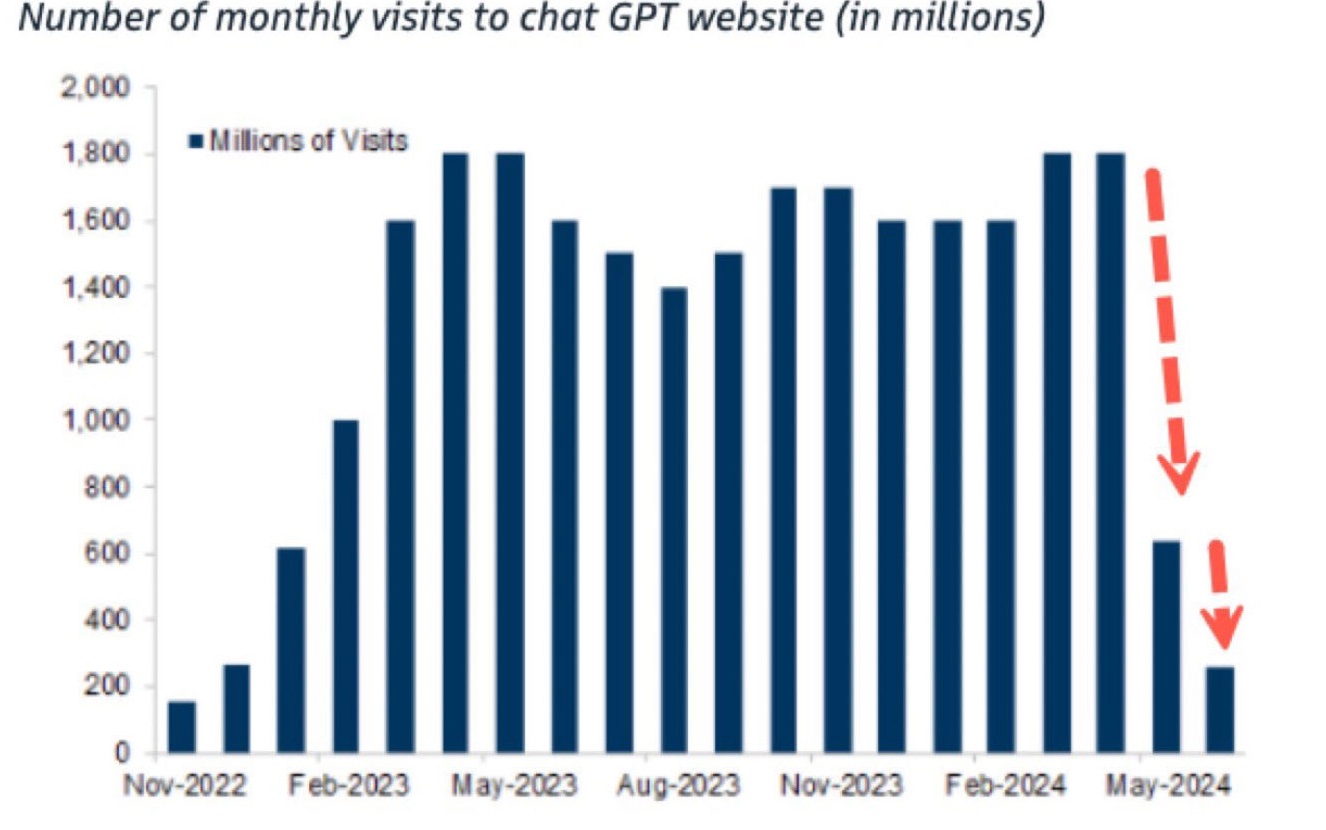

Here’s the graph that made Oppenheimer believe that ChatGPT was losing users.

In his analysis of the graph, Oppenheimer said, “Furthermore, the original ‘excitement’ about chat-GPT is fading in terms of monthly users (Exhibit 11). This does not mean, of course, that the growth rates in the industry will not be strong, but it does suggest that the next wave of beneficiaries may come from the new products and services that can be created on the back of these foundation models.”

Investors wondering if it was time to take profits or delay investing in OpenAI and related stocks were spooked when they read the report featured in the Financial Times. NVIDIA, which is heavily dependent on the future of AI, saw its shares fall 4% on Friday, hitting their lowest point in weeks.

The problem though is that the graph Oppenheimer used in his report didn’t capture the reality of what was happening. The decline in visitors to chat.openai.com was not because users were leaving ChatGPT. It was because OpenAI was migrating the service to its new URL at chatgpt.com.

Similarweb, which tracks website traffic, noted that even though there was a slight dip in ChatGPT traffic in July, the trend in ChatGPT users continues to grow.

For the first time since December 2023, ChatGPT showed a drop in month-over-month traffic during July 2024. However, as a testament to the significant progress of the OpenAI tool, July’s traffic still increased by 74% year-over-year.https://t.co/dL9iz4jLT6 pic.twitter.com/ODcXb1BF6w

— Similarweb (@Similarweb) August 11, 2024

Not realizing that OpenAI was using a new domain for ChatGPT, Oppenheimer assumed that the good times could be over and his report’s effect on share prices was evident.

It’s an example of how volatile the AI investor market is and how prone it is to announcements, rumors, and disinformation, albeit unintentional in this case.

OpenAI is eyeing new investors with a $100B valuation in its sights and expects revenue of between $3.5 to $4.5 billion this year. If it releases Strawberry in the fall, it could see a continuation of positive AI sentiment which could be good news for tech stocks like NVIDIA.

California’s proposed SB 1047 AI safety bill is on Governor Newsom’s desk waiting for him to either sign it into law or veto it. Employees at OpenAI, Anthropic, Google, Meta, and others came out in support of the bill in an open letter published yesterday.

Newsom’s decision may have an even bigger effect on tech stock prices than a misread ChatGPT user graph.